Did you know that leveraging credit card transfer partners can turn a 60,000 points welcome bonus into $1,200 worth of travel or a lot more? I’ve been maximizing transfer partners for over 5 years, and I’m excited to share everything I’ve learned! In fact, just last month, I transferred 100,000 Chase Ultimate Rewards points to Air France and booked two one-way business class tickets to Europe that would have cost $11,000 in cash. That’s the power of understanding how to leverage credit card transfer partners effectively.

If you’re new to the world of credit card rewards, transfer partners might seem overwhelming at first. I get it! If you’re just getting started with credit card rewards, check out my Beginner’s Guide to Credit Card Rewards first for a solid foundation. Once you’re ready, I’ll help you avoid common pitfalls and show you exactly how to maximize your points.

In this comprehensive guide, you’ll learn everything from the basics of how transfer partners work to advanced strategies that can help you get a lot more value from your points. Whether you’re planning your first points transfer or looking to level up your reward travel game, this guide has you covered.

Understanding Transfer Partners Basics

Let me break down what transfer partners are in simple terms. Think of your credit card points like a universal currency that you can convert into different “local currencies” – in this case, airline miles or hotel points. It’s similar to how you might exchange dollars for euros when traveling to Europe, except in this case, you’re exchanging your credit card points for various travel rewards.

I remember when I first discovered transfer partners – it was like finding a secret passage to premium travel! Previously, I had only been redeeming points through my credit card’s travel portal for economy tickets, getting a flat rate of 1-1.25 cents per point. But once I learned about transfer partners, everything changed. Suddenly, I was getting incredible values like a business class flight for 50,000 points that would have otherwise cost over $5,000!

Here’s what you need to know about the basics:

Transfer partners come in two main flavors: airlines and hotels. Each major credit card program (Chase Ultimate Rewards, American Express Membership Rewards, etc.) has its own set of partners. Think of these programs as your home base, and the partners as different destinations where you can send your points.

The really cool thing about transfer partners is the flexibility they offer. You’re not locked into any single airline or hotel program. Instead, you can wait until you need to book something specific, then transfer your points to whatever partner offers the best value for that particular trip.

Two crucial elements to understand are transfer ratios and transfer times. Most transfers happen at a 1:1 ratio, meaning one credit card point becomes one mile or point in the partner program. However, some transfers might be at different ratios, like 2:1 or 1:2. Also, pay attention to transfer times. Most points transfers are instant, but there are a handful of partners that take up to several days to post your points. To help you keep track of all the transfer partners, their ratios, and transfer times, I’ve created a comprehensive reference sheet that you can download here.

Important Note About Award Availability: The redemption examples shared in this guide demonstrate what’s possible with transfer partners, but it’s important to understand that these sweet spots depend heavily on award availability. Airlines and hotels release a limited number of award rooms or seats, and popular routes or properties may be difficult to book, especially during peak travel seasons. Additionally, award pricing can vary based on demand, season, and program changes. While these high-value redemptions are absolutely achievable, they often require flexibility with dates, advance planning, and sometimes a bit of luck. I recommend setting flexible travel dates and being ready to book when you find availability that works for you.

Major Credit Card Transfer Programs Compared

Now, let’s get into the nitty-gritty of each major credit card program and their transfer partners. I’ve personally used all of these programs extensively, and each has unique sweet spots that can help you maximize value.

Chase Ultimate Rewards

Ultimate Rewards is widely regarded as one of the most versatile points programs. It boasts the most domestic airline transfer partners of any program, including United MileagePlus, Southwest Rapid Rewards, and JetBlue TrueBlue. Additionally, Ultimate Rewards transfers to numerous international airlines such as British Airways Avios, Air Canada Aeroplan, and one of my personal favorites – Air France/KLM Flying Blue.

While transferring points to airlines often provides the most value, my top Chase transfer partner is actually Hyatt. For consistent value, Hyatt stands out—plus, Chase is one of only two transfer partners to Hyatt. For example, I recently transferred 60,000 Chase points to Hyatt points for a four-night stay at The Tribune Rome, part of JdV by Hyatt. The room was selling for $600 per night, delivering incredible value for my points!

American Express Membership Rewards

Membership Rewards stands out for having the most extensive airline transfer partner network of any program. With 18 airline partners, it offers access to all three major airline alliances (Star Alliance, Oneworld, and SkyTeam). One of the program’s biggest strengths is its frequent transfer bonuses—I’ve seen bonuses as high as 40% to British Airways and Virgin Atlantic. These bonuses can turn already valuable sweet spots into extraordinary deals.

For example, earlier this year, I transferred 77,000 Membership Rewards points to Iberia with a 30% bonus. This gave me enough Iberia Avios points to book two one-way business class tickets to Madrid on Iberia. The tickets would have cost nearly $6,000 otherwise, delivering a value of over 7 cents per point, including taxes and fees.

Another program worth considering during a transfer bonus is Hilton Honors. Membership Rewards points transfer to Hilton at a 1:2 ratio. At first glance, this may seem like excellent value, but Hilton points are typically valued at just 0.5 cents per point. For most redemptions, it doesn’t make sense to transfer to Hilton unless there’s a transfer bonus and you’re booking an aspirational property.

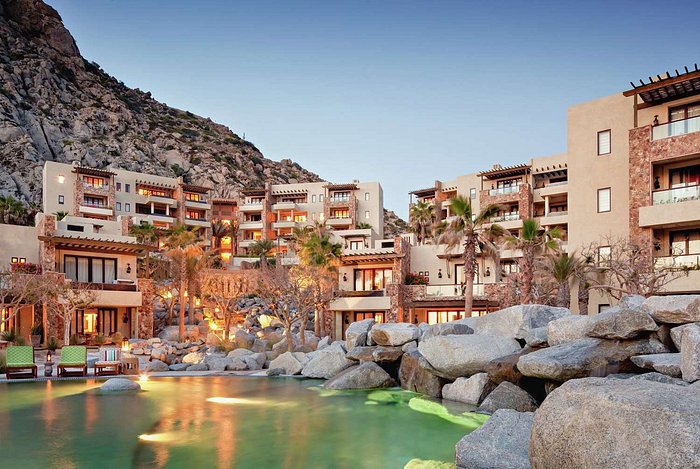

For instance, during a 40% transfer bonus, every Membership Rewards point converts to 2.8 Hilton Honors points. Hilton caps standard award stays, enabling you to get exceptional value at luxury properties. Recently, I stayed three nights at the Waldorf Astoria Los Cabos Pedregal for 360,000 Hilton Honors points. The same stay would have cost over $5,000. I used Hilton free night certificates for this stay, but If I had transferred Membership Rewards points during a 40% bonus, I would have needed just 129,000 points. That’s nearly 4 cents per point – an outstanding value for Membership Rewards points!

Capital One Miles

Capital One offers 18 transfer partners, providing a mix of unique and valuable options, including TAP Air Portugal, EVA Air, and Turkish Airlines. While its roster isn’t as appealing as Chase or American Express, it stands out for specific opportunities.

One of the best uses of Capital One Miles is transferring to Turkish Airlines for United domestic flights. Turkish Airlines’ award chart lets you fly economy anywhere in the U.S., including Hawaii, for just 7,500 miles one-way or first class for only 12,500 miles one-way.

Another excellent opportunity is transferring Capital One Miles to Avianca LifeMiles to book international business class flights on Star Alliance partners like Lufthansa, Singapore Airlines, United, and ANA. Avianca’s zone-based award chart delivers outstanding value, and it avoids fuel surcharges. For example, you can book business class from the U.S. to Europe for just 63,000 Capital One Miles. With transfer bonuses, these deals become even sweeter!

Citi ThankYou Points

Citi ThankYou Points provide excellent value through their 17 transfer partners, including Air France/KLM Flying Blue, Turkish Airlines Miles&Smiles, and Virgin Atlantic Flying Club, all of which transfer at a 1:1 ratio. While Citi’s partner network isn’t as extensive as other programs, its standout partnerships with Choice Privileges and Turkish Airlines Miles&Smiles make it a competitive option.

One of the best ways to maximize Citi ThankYou Points is by transferring them to Choice Privileges. Thanks to a 1:2 transfer ratio, every Citi point converts into 2 Choice Privileges points, creating incredible opportunities – especially in pricey European markets where Choice partners with Preferred Hotels & Resorts and other luxury properties. Choice’s extensive footprint in Europe includes boutique and luxury properties, often priced at hundreds of euros per night, making them especially appealing.

For example, I transferred 30,000 ThankYou Points to Choice Privileges, receiving 60,000 Choice points. I used these points to book two nights at the Ascend Hotel Collection’s Hotel Aquarius in Venice, where rooms were selling for $400 per night. That’s a value of nearly 4 cents per ThankYou Point!

Bilt Rewards

Bilt Rewards stands out as a unique program in the points and miles space because it’s the only way to earn transferable points on rent payments without fees. While it has fewer transfer partners compared to Chase or American Express, Bilt’s curated list of partners includes some of the most valuable loyalty programs.

What sets Bilt apart is its unique transfer partnerships. It’s the only program, aside from Chase, that transfers to World of Hyatt, and it exclusively transfers to Alaska Airlines. These partnerships significantly enhance the value of Bilt points, as both Hyatt and Alaska Airlines consistently offer some of the best redemption options in travel rewards.

By transferring points to Hyatt, you can book Category 4 properties for just 15,000 points per night, including high-demand hotels like the Hyatt Regency Grand Cypress Resort in Orlando, where rooms frequently cost $400+ per night.

Alaska Airlines Mileage Plan is among the most rewarding airline loyalty programs available. With generous award routing rules and partnerships with carriers like Japan Airlines and Cathay Pacific, it opens up exceptional redemption opportunities. For instance, you can transfer 70,000 Bilt points to Alaska and book business class to Asia on Japan Airlines, or use 50,000 points for business class to Europe on partners like Finnair. Additionally, Alaska’s program offers a free stopover on international award tickets, even on one-way flights, maximizing the value of your points.

Beyond these partnerships, Bilt transfers to other valuable programs like Air Canada Aeroplan, Turkish Miles&Smiles, and United MileagePlus. All transfers process at a 1:1 ratio, and most are instantaneous. Plus, Bilt frequently offers transfer bonuses that can make these sweet spots even more attractive.

How to Execute Point Transfers Successfully

The mechanics of transferring points might seem straightforward, but there’s a process you should follow to ensure you get maximum value. Here’s my step-by-step approach that has helped me avoid costly mistakes:

Step 1: Check Award Availability First

Never transfer points before confirming award availability! This is absolutely crucial as most point transfers are irreversible. Here’s my process:

- Search for award space on the partner airline’s website.

- Note exact flight numbers and times.

- Take screenshots of the availability.

- Check alternate dates in case your preferred date gets booked before your points transfer (sometime it can take several days).

- For more complex bookings, verify availability on other partner airlines to make sure the award availability is not phantom space. In some cases, I even call the airline to confirm.

Step 2: Check for Transfer Bonuses

Before transferring points, always check for active transfer bonuses in the program(s) you’ll be transferring from. These can significantly boost your value. For instance, a 30% transfer bonus turns 100,000 points into 130,000 partner miles/points. This can make the difference between booking economy and business class!

Step 3: Calculate the Value

Before transferring, always calculate the cents-per-point value you’ll receive. Here’s the formula I use:

(Cash price – Taxes and fees) ÷ Number of points needed = Value per point

For example:

- Cash price: $3,800

- Taxes/fees: $200

- Points needed: 50,000

- Value calculation: ($3,800 – $200) ÷ 50,000 = 6 cents per point.

The values I aim for when transferring points to partners are:

- Economy flights: 1.5+ cents per point

- Business/First class: 3+ cents per point

- Hotel stays: 1.5+ cents per point

Step 4: Consider Transfer Times

Different partners have different transfer times, which can impact your booking strategy. Most transfers are instant, but there are few notable partners with slower transfer times including, ANA, Cathay Pacific, Singapore Airlines, and Turkish Airlines.

For slower transfers, I recommend:

- Using the “hold” feature when available (Turkish Airlines offers free 48-hour holds). You will need to call the airline and speak to an agent.

- Having a backup plan if availability disappears.

- Crossing your fingers!

Step 5: Execute the Transfer and Book

Once you’re ready to transfer:

- Double-check all details.

- Verify your frequent flyer number is correct and your account information (e.g. email, full name). If there’s a discrepancy between the partner account information and your credit card information, the transfer may not complete.

- Keep screenshots of the transfer confirmation.

- Book your award as soon as the points arrive.

- Save all confirmation emails.

Common Mistakes to Avoid

Transferring Without Confirming Availability

The most costly mistake is transferring points before confirming award space. Once you transfer points, you typically can’t transfer them back and some programs have a hard expiry date, meaning you run the risk of losing those valuable points if you can’t use them. Always:

- Verify actual availability before transferring by calling the airline or checking other alliance partners.

- Double-check that you’re seeing standard award space, not space reserved for elite members.

- Confirm the points price matches what you expect to pay.

Not Checking Account Details

Simple account mismatches can delay or prevent transfers:

- Names and email addresses must match exactly between credit card and loyalty accounts.

- Some programs require accounts to be open for a certain period.

- Keep loyalty accounts active to avoid any transfer issues.

Overlooking Transfer Times

Don’t assume all transfers are instant:

- Some partners take 3-7 days to process transfers.

- Award space can disappear during the transfer window.

- Not having a backup plan if availability changes.

Ignoring Transfer Bonuses

Missing out on extra value by:

- Not checking for current transfer bonuses.

- Not calculating the bonus into your total points needed.

Making “Test” Transfers

Never make small “test” transfers to see if the process works! This is a costly mistake because:

- Small transfers often trigger fraud alerts, which can lock your account and delay future transfers when you really need them.

- Most transfers are irreversible.

- You’ll end up with orphaned points in loyalty programs.

- Small point balances often expire unused.

Frequently Asked Questions

Can I transfer points back if I change my mind? No, point transfers are almost always irreversible. Once you transfer points to an airline or hotel program, they cannot be transferred back to your credit card program.

Do my transferred points expire? Once transferred, your points follow the expiration rules of the airline or hotel program, not your credit card program. Each loyalty program has different expiration policies, so check these before transferring.

What happens if the transfer doesn’t go through? If a transfer fails, the points typically return to your credit card account within 5-7 business days. Always contact your credit card issuer and transfer partner if you notice any issues.

Can I transfer points to someone else’s loyalty account? Most programs only allow transfers to accounts belonging to the primary cardholder or authorized users. Some airline and hotel programs allow transfers to other members or points pooling.

What’s the minimum number of points I can transfer? Most programs require a minimum of 1,000 points.

How long do transfers typically take? While many transfers are instant, some can take up to 7 days. Always check transfer times for your specific partner before initiating a transfer.

Which credit card should I start with? The best card depends on your spending habits and travel goals. Check out my Best Credit Cards post for personalized recommendations, and if you’re new to credit card rewards, start with my Beginner’s Guide first.

Key Takeaways

- Never transfer points without first confirming award availability – transfers are almost always irreversible.

- Create your loyalty program accounts well in advance and ensure account details match exactly across programs to avoid transfer issues.

- Avoid making small “test” transfers as they can trigger fraud alerts and leave you with orphaned points.

- Always check for transfer bonuses before transferring points and know typical transfer times for your desired program.

- Have a backup plan ready, especially for programs with slower transfer times, in case award space disappears.

Don’t forget to download my Free Transfer Partners Reference Sheet and Subscribe to my newsletter and get the latest strategies on credit card rewards, savings, and personal finance delivered straight to your inbox!

Phillip founded Hacking Your Finances after reaching financial independence in 2024 and leaving his corporate career to follow his passion for helping others optimize their finances. Combining his love for personal finance and travel hacking with years of professional expertise, he provides practical strategies to help readers maximize credit card rewards and achieve their financial goals.