Credit cards can be powerful financial tools when used responsibly. But if you’re not careful, they can lead to costly mistakes. Did you know that the average American carries a significant amount of credit card debt, paying unnecessary interest? According to the Federal Reserve’s latest Survey of Consumer Finance, the average U.S. household carries a credit card balance of more than $6,000. Whether you’re new to credit cards or an experienced user, understanding the common pitfalls can save you thousands of dollars and years of financial stress. Let’s dive into the most costly credit card mistakes you should avoid and more importantly, how to avoid them!

1. Late Payments

Missing payments is one of the easiest ways to damage your credit score and rack up significant fees.

- The Impact: Late payments can lower your credit score and result in hefty penalties. According to Experian, a single missed payment can lower your credit score by up to 100 points, and 35% of cardholders report missing at least one payment annually. Additionally, the average late fee for credit cards is currently around $8, following a rule change by the Consumer Financial Protection Bureau (CFPB) in 2024. Previously, the average fee was closer to $32, making this a significant reduction.

- How to Avoid It: Set up autopay for at least the minimum payment or schedule reminders on your phone.

- If You Miss a Payment: Contact your credit card issuer immediately to request a fee waiver and ensure you pay as soon as possible to avoid further damage.

2. Carrying a Balance:

This is one of the most common and costly mistakes people make. Carrying a balance leads to exorbitant interest costs that compound each month the balance remains. Many believe carrying a balance improves their credit score, but it doesn’t. In fact, it can hurt your score by increasing your credit utilization ratio (the percentage of your total available credit you’re using), which lowers your score.

- The Impact: Paying less than the full balance means you’re stuck paying high interest on the remaining balance. Additionally, your credit score may be negatively affected by a higher credit utilization ratio.

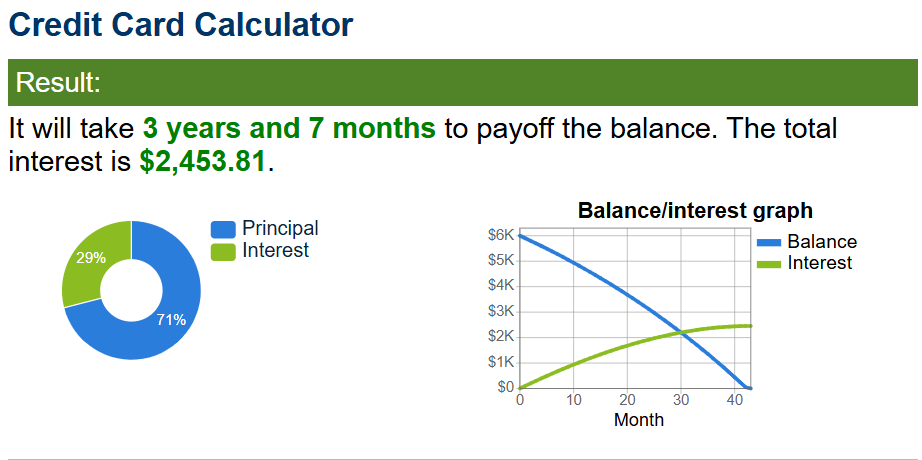

- Why It Matters: Compounding interest can lead to significant debt over time, threatening your long-term financial goals. With the average credit card interest rate at 20.35% in 2024, according to Bankrate, it’s easy to see how debt can spiral. To put this into perspective, I used an interest calculator to see the impact of carrying a $6,000 balance while making only $200 monthly payments and the results were eye-popping. You’d pay over $2,400 in interest alone, and it would take 3 years and 7 months to pay off the balance!

- Solution: Avoid making purchases you can’t afford, and commit to paying off your balance in full each month. If that’s not feasible, prioritize paying down high-interest debt first. For more detailed guidance, check out my article How to Build a Solid Foundation to learn how to effectively pay down debt while building financial security.

3. Ignoring Your Credit Card Statement

Your monthly statement is more than just a bill—it’s a record of your financial activity.

- Common Errors: Unauthorized charges or billing mistakes can cost you money if unnoticed.

- What to Look For: Double-check charges, especially recurring subscriptions or large transactions.

Action Steps: Look at your statements regularly or use a budget app like Monarch Money to track your spending. Dispute any inaccuracies with your credit card issuer promptly.

4. Using Credit Cards for Cash Advances

Taking out cash using your credit card might seem convenient, but it’s an expensive mistake.

- The Impact: Cash advances come with high fees and immediate interest, often at a higher rate than regular purchases. Fees typically range from 3% to 5% of the advance amount.

- Why It Matters: Many cardholders underestimate how quickly cash advance costs add up, making this one of the most expensive ways to access cash.

- How to Avoid It: Familiarize yourself with your card’s cash advance terms to understand the true cost before considering it. Use your debit card instead if you need cash. Save credit cards for purchases you can pay off in full.

5. Neglecting Credit Card Terms and Fees

Small print matters when it comes to credit cards.

- Impact: Annual fees, foreign transaction fees, and penalty APRs can add up.

- Understanding Terms: Know your card’s grace period and interest rates to avoid surprises.

- Actionable Tips: Review terms periodically to stay aware of changes. Keep track of the key terms and fees in a spreadsheet for easy reference.

6. Overspending to Earn Sign-up bonuses

Big sign-up bonuses can be tempting, but overspending to earn points often backfires.

- The Impact: Spending more than you can afford to meet sign-up bonus requirements can lead to debt, high interest charges, and derail your savings goals, ultimately negating the value of the sign-up bonus.

- Smart Strategies: Only spend what you’d already budgeted for and prioritize cards with attainable sign-up bonuses.

- The Bottom Line: Rewards should work for you, not the other way around. If you’re new to credit card rewards, check out my article The Ultimate Beginner’s Guide to Credit Card Rewards for tips on maximizing points and cash back without overspending.

7. Closing Credit Cards Without a Plan

Closing accounts can hurt your credit score and even your relationship with the issuer.

- The Impact: It affects your credit utilization ratio and length of credit history, both of which are key factors in determining your credit score.

- When to Close: Only close cards if the fees outweigh the benefits and you no longer need the credit line. It’s a good practice to keep no-annual-fee cards open, especially those you’ve had for a long time.

- Alternatives: Consider downgrading (product changing) to a no-fee version instead of canceling. Ask the issuer for a retention offer to keep the account open.

Key Takeaways

- Set up autopay to avoid costly late payments and protect your credit score.

- Always pay off your balance in full to avoid crippling interest charges.

- Review your monthly credit card statement for errors and unauthorized charges.

- Stick to a budget to avoid overspending, even when chasing sign-up bonuses.

- Familiarize yourself with your card’s terms, and fees.

- Avoid closing old cards unnecessarily to maintain a healthy credit history and utilization ratio.

Want more tips and strategies to save more money? Subscribe to the newsletter for the latest tips, best credit card offers, latest deals, and strategies to maximize your savings.

Phillip founded Hacking Your Finances after reaching financial independence in 2024 and leaving his corporate career to follow his passion for helping others optimize their finances. Combining his love for personal finance and travel hacking with years of professional expertise, he provides practical strategies to help readers maximize credit card rewards and achieve their financial goals.