Think of a 401(k) as your personal money-growing machine for retirement. If you’re reading this, you’ve probably heard the term thrown around at work or seen it on your pay stub, but maybe you’re not quite sure what it means for you. Don’t worry – you’re not alone. Understanding retirement accounts and making the right decisions about them is a common challenge for many Americans.

In this comprehensive guide, we’ll break down everything you need to know about 401(k) plans in simple terms. Whether you’re just starting your first job or looking to make better retirement decisions, you’ll learn exactly how these powerful retirement accounts work and how to make them work for you.

By the end of this guide, you’ll understand:

- What a 401(k) is and why it’s crucial for your future

- How to set up and manage your account

- Simple strategies to maximize your retirement savings

- Examples of how to build substantial retirement savings

What Is a 401(k)?

A 401(k) is a retirement savings account that your employer offers as a benefit – think of it as a special savings account with tax advantages and the potential for free money from your employer. Named after section 401(k) of the Internal Revenue Code, these plans were created in 1978 when Congress realized Americans needed more options to save for retirement beyond traditional pensions.

The beauty of a 401(k) lies in its structure. Your contributions are automatically deducted from your paycheck before taxes (in most cases), making it easier to save consistently. Plus, many employers offer matching contributions – essentially free money added to your account when you contribute.

There are three main types of 401(k) plans:

1. Traditional 401(k)

Your contributions reduce your taxable income now, and you pay taxes when you withdraw the money in retirement. Example: If you make $60,000 and contribute $6,000 to your Traditional 401(k), you’ll only be taxed on $54,000 of income this year.

2. Roth 401(k)

You pay taxes on contributions now, but withdrawals in retirement are tax-free. Example: If you contribute $6,000 to a Roth 401(k), you’ll pay taxes on the full $60,000 now, but when you retire, all the money you withdraw – including investment gains – is tax-free.

3. Solo 401(k)

Designed for self-employed individuals and business owners with no employees besides themselves and their spouses.

How Does a 401(k) Work?

Let’s break down the process into simple steps:

1. Payroll Deduction

When you enroll in your 401(k), you choose a percentage of your salary to contribute. Let’s say you decide on 6% from each paycheck:

- Your salary: $60,000/year ($5,000/month)

- Your 6% contribution: $300/month This money goes directly from your paycheck into your 401(k) account before you ever see it – making saving automatic and painless.

2. Investment Selection

Your contributions don’t just sit in a savings account; they’re invested in options your employer’s plan offers. Typically, you can choose from:

- Stock funds (higher risk, potentially higher return)

- Bond funds (lower risk, typically lower return)

- Target date funds (automatically adjusted based on your retirement year)

Here’s a realistic example of how this works: Sarah contributes $300 monthly and invests in a target date fund. Her employer matches 50% of her contributions up to 6% of her salary. Here’s what happens each month:

- Sarah’s contribution: $300

- Employer match: $150

- Total monthly investment: $450

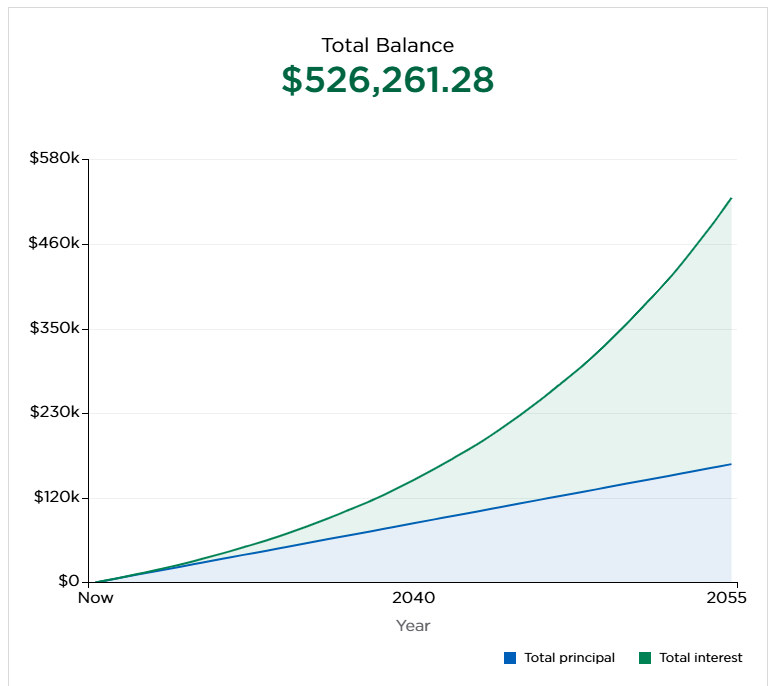

3. Growth Through Compound Interest

This is where the magic happens. Your money doesn’t just sit there – it grows through compound interest. Both your contributions and any earnings are reinvested, creating a snowball effect over time.

Let’s look at Sarah’s potential growth over 30 years, assuming a 7% average annual return:

- Total contributions: $108,000 ($300 × 12 × 30)

- Employer match total: $54,000 ($150 × 12 × 30)

- Portfolio returns: Account value after 30 years = $526,000

This example shows the power of:

- Regular contributions

- Employer matching

- Long-term compound growth

- Tax-advantaged savings

Remember: These numbers are for illustration purposes only. Actual returns will vary based on market performance, your contribution level, and your investment choices.

Employer Matching – AKA “Free Money”

Employer matching is one of the most valuable features of a 401(k) plan. Here’s how it works:

Most Common Matching Formulas

- Dollar-for-dollar match up to a certain percentage

- Partial match (like 50%) up to a certain percentage

- Tiered matching (different rates for different contribution levels)

Example of a “50% up to 6%” Match: Let’s say you earn $50,000 annually with this match:

- You contribute 6% = $3,000/year

- Your employer matches 50% = $1,500/year

- Total going into your account = $4,500/year

Understanding Vesting

Vesting determines when you own your employer’s matching contributions. The two common schedules are:

- Cliff vesting: 100% ownership after a specific period (usually 3-5 years)

- Graded vesting: Gradual ownership increase (e.g., 20% per year)

Here’s a hypothetical example of how Steven got $50,000 in free money when he started at his company in 2014:

- Salary: $60,000

- Company match: 100% up to 5%

- His monthly contribution: $250

- Company’s monthly match: $250 Over 10 years:

- His total contributions: $30,000

- Company’s total match: $30,000

- Growth from matching funds alone: $20,000

- Total benefit from matching = $50,000

2025 Contribution Limits

Understanding 401(k) contribution limits isn’t just about knowing the numbers – it’s about maximizing every opportunity to build your retirement savings. These IRS-set limits typically change yearly to account for inflation, and making the most of them can significantly impact your retirement nest egg. Whether you’re just starting out or catching up on retirement savings, here are this year’s contribution limits:

- Under age 50: $23,500

- Age 50 or older: $31,000 (includes $7,500 catch-up)

Common Investment Options Within Your 401(k)

Opening your 401(k) account is just the first step – choosing where to invest your money is equally important. Think of your investment options like different vehicles for your journey to retirement: some are built for speed (higher risk, potentially higher return), while others are designed for a smoother, more predictable ride (lower risk, typically lower return).

Most 401(k) plans offer a carefully selected menu of investment options, typically ranging from conservative to aggressive. While the specific choices may vary by employer, understanding these common options will help you build a portfolio that matches your retirement goals and risk tolerance.

Before we dive into specific options, remember three key principles:

- Diversification helps manage risk

- Your age and retirement timeline should influence your choices

- Fees matter – they can significantly impact your long-term returns

Let’s explore the most common investment options you’ll likely find in your 401(k) plan:

Target Date Funds

- Automatically adjusted risk based on expected retirement year

- Example: “Target Date 2055 Fund”

- Simple, automatic rebalancing

- May have higher fees

Index Funds

- Track specific market indexes

- Usually lower fees

- Examples: S&P 500 index funds

Mutual Funds

- Most are actively managed

- Various strategies available

- Generally higher fees

Managing Your 401(k)

Your 401(k) isn’t a “set it and forget it” account – think of it more like a garden that needs regular attention to flourish. While you don’t need to watch it daily, regular maintenance ensures your retirement savings stay on track and continue growing according to your goals. Even just a few hours each year can make a significant difference in your long-term returns.

Let’s break down the essential maintenance tasks to keep your 401(k) working hard for your future:

- Review quarterly statements

- Rebalance annually

- Adjust contributions accordingly with salary increases

- Review investment choices yearly

Online Management Tips:

- Set up two-factor authentication

- Keep beneficiary information updated

- Download statements for records

- Set up automatic rebalancing if available

Special Situations

Life rarely moves in a straight line, and your 401(k) journey won’t either. While traditional advice focuses on steady contributions and long-term growth, you’ll likely encounter situations that require important decisions about your retirement savings. Whether you’re changing jobs, facing financial hardship, or considering a loan, understanding how to handle these special situations can protect your retirement savings and keep you on track toward your goals.

Let’s explore the most common scenarios you might face and how to navigate them wisely:

Job Changes and 401(k) Rollovers

When you change jobs, you have several options for your 401(k):

1. Roll Over to New Employer’s 401(k)

- Keep retirement savings consolidated

- Maintain tax-deferred status

- Access new investment options

- Must check if new plan accepts rollovers

2. Roll Over to an IRA (Individual Retirement Account)

- Get more investment choices

- Often have lower fees

- Maintain tax-deferred status

- Greater control over your investments

3. Keep Money in Previous Employer’s Plan

- No immediate action needed

- Can leave it if balance is over $5,000

- Maintain current investments

- May have higher fees or limited access

4. Cash Out (Not Recommended)

- Pay 20% mandatory tax withholding

- Pay 10% early withdrawal penalty if under 59½

- Lose future tax-deferred growth

- Significantly impact retirement savings

Important Tips:

- Always choose direct rollovers (plan-to-plan) to avoid tax complications

- Never accept a check made out to you personally

- Compare investment options and fees before deciding

- Consider consulting a tax advisor for large rollovers

401(k) Loans: Understanding the Risks

While the idea of borrowing from yourself might seem like a smart financial move – after all, you’re paying the interest back to your own account – 401(k) loans come with hidden costs and risks that many borrowers don’t fully understand. Before tapping into your retirement savings, it’s crucial to understand both the mechanics of these loans and their potential impact on your long-term financial security. Below are the major elements of a typical 401(k) loan and an example of the potential cost impact:

Loan Basics:

- Borrow up to 50% of vested balance or $50,000 (whichever is less)

- Must repay within 5 years (longer for primary home purchases)

- Interest rates typically prime rate + 1%

Hidden Costs:

- Lost investment growth

- Double taxation on interest payments

- Reduced take-home pay during repayment

- Risk of default if you leave your job

Example: Cost of a $20,000 401(k) Loan

- 5-year repayment term

- 6% interest rate

- Lost investment returns (assuming 7%): $4,700

- Extra taxes on interest: ~$300

- Total real cost = $5,000 above loan amount

Common 401(k) Mistakes

Even the savviest investors can make mistakes with their 401(k)s, but the most costly errors are often the easiest to avoid. Think of these as the retirement equivalent of leaving money on the table – or worse, accidentally throwing it away. By learning from others’ missteps, you can protect your retirement savings and keep your financial future on track. Here are the most common – and costly – mistakes I see:

Not Investing Your Contributions

One of the most costly mistakes is leaving your contributions sitting in cash or a money market fund. Here’s an example of what could happen:

Skylar contributed $400 monthly to her 401(k) for 10 years but never selected her investments. Her money sat in her plan’s default money market fund:

- Total contributions: $48,000

- Average money market return: 0.5%

- Account value after 10 years: $49,000

If Skylar had invested in a diversified portfolio:

- Same $48,000 in contributions

- Average market return: 7%

- Account value after 10 years: $69,000.

- Total opportunity cost = $20,000

Why This Happens:

- Confusion about investment options

- Fear of making the wrong choice

- Forgetting to complete investment selection

- Not realizing contributions default to cash/money market

How to Fix It:

- Log into your 401(k) account

- Check your current balance and where it’s allocated

- Select investment options based on your age and risk tolerance

- Set up automatic rebalancing if available

- Review quarterly to ensure new contributions are being invested

Not getting full employer match

Another costly mistake is not taking full advantage of your employer’s match (remember, it’s free money). Here’s an example of the impact:

Seth contributed 2% of his $60,000 annual salary to his 401(k) from age 30 to 50. Despite his company offering a generous 100% match of up to 6% of his salary, he never took advantage of this benefit. Let’s break down the true cost of this mistake:

Annual Impact:

- 6% of salary = $3,600 (what he should have contributed)

- 2% of salary = $1,200 (what he actually contributed)

- Missed contribution: $2,400/year

- Missed company match: $2,400/year

- Total annual loss = $4,800

20-Year Impact (assuming 7% average annual return):

- What Seth Actually Accumulated:

- His contributions ($1,200/year): $24,000

- Company match on 2%: $24,000

- Total contributions: $48,000

- Account value after growth: $98,000

- What Seth Could Have Had:

- His contributions ($3,600/year): $72,000

- Company match on 6%: $72,000

- Total contributions: $144,000

- Account value after growth: $295,308

Total Cost of the Mistake:

- Lost company matches: $48,000

- Lost investment growth: $149.000

- Total opportunity cost = $197,000

Why This Happened:

- Seth thought he couldn’t afford 6%

- Didn’t understand the match was guaranteed 100% return

- Focused on short-term budget instead of long-term benefits

- Never ran the numbers to see true impact

Life Impact:

- Delayed retirement potential by 5-7 years

- Needs to save significantly more later to catch up

- Missed tax advantages on higher contributions

- Lost opportunity for compound growth on matched funds

How to Avoid Seth’s Mistake:

- Calculate your company’s full match

- Create a budget and evaluate your spending to reach full match percentage

- Start with a lower percentage if needed, but increase gradually

- Set up automatic contribution increases with raises

- Review your contribution percentage annually

- Use tax savings from contributions to offset budget impact

Other Common Mistakes

- Cashing out when changing jobs

- Investing too conservatively

- Neglecting rebalancing

- Taking 401(k) loans unnecessarily

Getting Started Checklist

Taking those first steps with your 401(k) doesn’t have to be overwhelming. Think of this checklist as your roadmap to retirement savings success – a step-by-step guide to get your account up and running effectively. Whether you’re a new hire or just ready to start contributing, these actionable steps will help you build a strong foundation for your retirement savings. Let’s break it down into manageable tasks:

First 30 Days

□ Enroll in your company’s plan

□ Calculate optimal contribution percentage

□ Select investments based on age/risk tolerance

□ Name beneficiaries

□ Set up online account access

First 90 Days

□ Review first statements

□ Adjust contribution if needed

□ Understand vesting schedule

□ Create retirement goal

□ Set up automatic increases

Annual Tasks

□ Review investment performance

□ Rebalance portfolio

□ Update beneficiary information

□ Increase contributions with raises

□ Review fees and expenses

Frequently Asked Questions

Q: When can I withdraw without penalties? Age 59½ or older, or if you meet specific hardship criteria.

Q: What happens if I leave my job? You can roll over to a new 401(k), transfer to an IRA, or leave it with your old employer if allowed.

Q: Can I have multiple 401(k)s? Yes, but consolidating them often simplifies management.

Q: How do I choose investments? Consider your age, risk tolerance, and retirement timeline. Target date funds offer simple diversification. Ask your employer if you have access to a free financial advisor.

Resources to Help You Master Your 401(k)

Government Resources:

- IRS 401(k) Resource Guide https://www.irs.gov/retirement-plans/401k-plans

- Department of Labor’s EBSA https://www.dol.gov/agencies/ebsa/workers-and-families/retirement

Educational Resources:

- Investor.gov (SEC’s Educational Site) https://www.investor.gov/introduction-investing

- FINRA’s Retirement Calculator https://tools.finra.org/retirement_calculator/

Free Financial Planning Tools:

- Vanguard’s Retirement Income Calculator https://retirementplans.vanguard.com/VGApp/pe/PublicTools/RetirementIncome

- Fidelity’s Planning & Guidance Center https://www.fidelity.com/retirement-planning/overview

Money Management Tools:

- Download my free Personal Spending Plan for a ready-to-use solution to track your income and expenses

- Try budgeting apps like Monarch Money or YNAB.

Key Takeaways: Making the Most of Your 401(k)

Essential Actions:

- Get Your Full Match

- Never leave free money on the table

- Contribute at least enough to get your full employer match

- Example: If employer matches 100% up to 6%, contribute 6%

- Start Early & Be Consistent

- Time is your biggest advantage

- Small contributions grow significantly over decades

- Automatic payroll deductions make saving painless

- Invest Your Contributions

- Don’t leave money sitting in cash

- Choose investments based on your age and risk tolerance

- Consider target date funds for automatic rebalancing

- Understand Your Options

- Know your contribution limits

- Familiarize yourself with investment choices

- Understand vesting schedules for employer matches

- Avoid Common Mistakes

- Resist cashing out when changing jobs

- Don’t take loans unless absolutely necessary

- Review and rebalance investments annually

- Make sure contributions are actually invested

Remember:

- Your 401(k) is a powerful tool for building wealth

- Consistent contributions matter more than perfect investment choices

- Take advantage of tax benefits and employer matching

- Review your account quarterly

- Increase contributions with each raise

Subscribe for More Insights: Want more tips on building wealth, maximizing your money, and reaching your financial goals? Join my free weekly newsletter for actionable advice and exclusive strategies delivered straight to your inbox. Subscribe now and take control of your financial future!

Phillip founded Hacking Your Finances after reaching financial independence in 2024 and leaving his corporate career to follow his passion for helping others optimize their finances. Combining his love for personal finance and travel hacking with years of professional expertise, he provides practical strategies to help readers maximize credit card rewards and achieve their financial goals.