Saving money doesn’t have to mean giving up everything you love. With a little creativity, you can trim your expenses and still enjoy life. Here are three clever ways to save money every month:

1. Master the Art of Meal Planning and Prepping

Take control of your food budget by planning and preparing your meals in advance.

Start by creating a weekly meal plan that outlines your meals and grocery list, which helps you avoid last-minute takeout and reduces food waste. A well-organized grocery list ensures you only buy what you need, minimizing impulse purchases at the store. Stick to the list to keep your budget in check.

Dedicate one day a week (my favorite day is Sunday) to cooking and portioning out meals for the days ahead. Preparing a big batch of meals with versatile ingredients like chicken, rice, and vegetables can cover several lunches or dinners for the week.

I use the Ninja Foodi Air Fryer Pressure Cooker Combo to prepare most of our meals. It has been a game changer, saving me both money and time. If you’re thinking about meal prepping, I highly recommend investing in a multi-function cooker like the Ninja Foodi – you won’t regret it.

By incorporating meal planning, sticking to a grocery list, and preparing meals in advance, you can simplify your routine and make healthier, budget-friendly choices.

2. Cash in on Shopping Portals

Turn your everyday purchases into savings opportunities. Shopping portals allow you to earn cash back or points when shopping at your favorite stores. Whether you prefer points and miles or cold-hard cash, there are plenty of portals to choose from. Many portals even offer browser extensions that alert you to available offers and can automatically apply coupon codes. Also, sign up for email alerts to get notified of the best deals.

While most portals function similarly, two standouts I frequently use are Rakuten and TopCashback. These platforms consistently provide the best deals and are user-friendly.

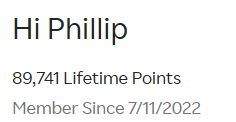

A unique feature of Rakuten is the ability to earn American Express Membership Rewards (MR) points instead of cash back by simply linking your MR-earning credit card to your Rakuten account. In just over two years, I’ve racked up 90,000 MR points just by shopping through Rakuten. That’s equivalent to $900 cash back (or significantly more value if you know how to maximize the use of MR points)!

I also use Cashback Monitor, which tracks earning rates across shopping portals, making it easy to see which portal will give you the most cash back, points, or miles.

Use my referral links for Rakuten and TopCashback to receive a free welcome bonus.

3. Create Friction to Reduce Spending

One surprisingly effective way to save money is by intentionally creating friction in your spending process. This means making it slightly harder to make impulse purchases, giving you time to reconsider. Here are some practical steps you can take to add friction to your spending.

- Remove saved payment methods from online shopping accounts. This simple step adds an extra layer of effort, which can deter unnecessary purchases.

- Implement a “cooling-off period” for non-essential purchases—wait 48 hours before buying to evaluate if you really need the item.

- Find an accountability partner to remind you to think twice before making impulse purchases. An accountability partner can be a powerful tool to help you stay disciplined with your spending. This could be a friend, family member, or partner who understands your financial goals and can help you stay on track. For instance, my accountability partner is my wife, and we have a rule to discuss any non-essential purchases over $100. This ensures we’re aligned and that the purchase will truly add value to our lives. Having someone to check in with adds an extra layer of responsibility, making it easier to think twice before making impulse buys and reinforcing good spending habits.

Key Takeaways

Saving money doesn’t have to be a struggle. By thinking outside the box and incorporating these simple strategies into your routine, you can boost your savings without sacrificing what you love. Start with small changes, stay consistent, and watch your savings grow.

Share your favorite creative money-saving strategies in the comments below!

Phillip founded Hacking Your Finances after reaching financial independence in 2024 and leaving his corporate career to follow his passion for helping others optimize their finances. Combining his love for personal finance and travel hacking with years of professional expertise, he provides practical strategies to help readers maximize credit card rewards and achieve their financial goals.